Commercial Surety Bonds

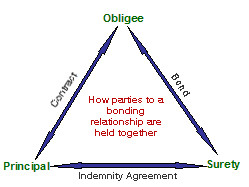

Throughout the country of Canada, surety bonds are utilized for a variety of different  purposes. Although they can be used in different situations, they all basically work in the same manner. The bond is set into place, in order to guarantee that the Principal will fulfill their duty, as it has been set forth in legislation or a contract. These bonds are provided by various surety companies and may be utilized to satisfy specific court orders, as well as governmental regulations.

purposes. Although they can be used in different situations, they all basically work in the same manner. The bond is set into place, in order to guarantee that the Principal will fulfill their duty, as it has been set forth in legislation or a contract. These bonds are provided by various surety companies and may be utilized to satisfy specific court orders, as well as governmental regulations.

Of course, commercial surety bonds are somewhat different from the other bonds available in Canada. Within this comprehensive guide, you will learn everything there is to know about commercial surety.

Types of Commercial Surety Bonds we provide:

- Auto Dealer Bond – Used in the automobile industry for dealerships.

- Fidelity Bond – Businesses purchase this bond to cover themselves from fraudulent employees.

- Janitorial Bond – Janitorial companies use this bond to protect the client’s interest.

- Utility Bond – Protects Utility companies from defaults from clients.

- Customs Bond – Required by the Federal government of Canada for brokers.

- Medical and Medicaid Bond – Protects patients from fraudulent behavior.

- Lottery Bond – Required to be purchased by business that engage in lottery.

- Union Bond – Obtained by union workers.

What Is A Surety Company?

A surety is a company that offers various types of bonds to individuals and companies within a specific industry. The surety bond company is responsible for making sure that the principal (company) follows the terms and agreement of the bond to a tee. The obligee (project owner) may request a construction surety bond, as protection from financial loss. Surety companies are also responsible for investigating claims made against specific bonds and paying out penal sums, whenever the need arises.

What Are Commercial Surety Bonds?

Commercial surety is a phrase, which is utilized to describe a variety of different bonds. Although each bond, within this category is different, they all help commercial  establishments respond to specific governmental and local province regulations and statutes. In many cases, these bonds work in conjunction with the licensing process and are usually required, before the company will be able to obtain their license.

establishments respond to specific governmental and local province regulations and statutes. In many cases, these bonds work in conjunction with the licensing process and are usually required, before the company will be able to obtain their license.

At the same time, these bonds can be very beneficial for consumers, by providing them with protection from various problems, including fraud and misrepresentation. Within Canada, provincial court, governmental bodies and even financial institutes generally require commercial surety bonds.

Different Types Of Commercial Surety

Again, the term commercial surety is used to identify a handful of different bonds. Although they all fit into this convenient category, they work differently. Below, you will be able to better familiarize yourself with some of the most common commercial surety bonds.

Custom & Excise Bond

As the name implies, this specific type of bond is directly associated with importing and distributing goods. These bonds are required by the Federal Government of Canada and confirm that your business will pay all required taxes and duties. With these bonds, your company will be able to transport its goods throughout the country in an efficient manner.

License & Permit Bonds

In all likelihood, your business needs to be licensed by your local province or by the Federal Government of Canada. Before you’ll be allowed to obtain that license, you will first need to obtain the appropriate license or permit bond. This bond also provides protection to consumers, by ensuring that your business will abide by all laws and regulations.

Estate Bond

Estate bond acts in conjunction with a life insurance policy. This bond transfers non-registered savings from a proposed tax investment into a tax-sheltered life insurance policy. This money will be given as an inheritance charity to someone you respect and love, when you pass away. The total sum can add up to a substantial monetary value over time, plus you will see a huge reduction in your taxes, just by purchasing an estate bond.

Lost Instrument Bonds

These bonds are capable of protecting the obligee from loss. The bond can protect all individuals involved in the event of destroyed or damaged certificates or other documents.

Carnet Bonds

Carnet bonds can be very beneficial for your business and will give it the ability to avoid VAT taxes, while also simplifying the customs process. If your company is going to be shipping and receiving products, this bond is certainly a necessity.

Although these are basic overviews of each type of bond, they can be broken into greater detail easily. Below, you will learn about more of the coverages provided by each type of bond.

Carnet Requirements

The Canadian Chamber of Commerce will require your business to obtain Carnet bonds, if you desire to import merchandise, yet intend to export it to another country, after a short period of time. The bond will give you the ability to avoid paying additional duties or taxes. There are two types of Carnet Bonds, including blanket and single trip bonds.

Canadian Customs

If your company works with the importation of merchandise, you will most likely be required to work with the Canadian Customs. Custom bonds will be required in Canada and are used to confirm that your company will pay the necessary duties. This type of bond can cover a handful of activities. Below, you will discover some of these.

- Temporary importation of goods

- Bonding a Carrier Operation

- Obtaining a Customs Broker License

- Released of Goods

Tax And Excise

Within the country of Canada, your company will need to pay specific taxes on some goods. The bond guarantees that your company will abide by the rules and will pay all excise taxes. These taxes include those on fuel, sales and tobacco.

License And Permit

Certain professionals will need to obtain a license, before they’ll be allowed to work within Canada legally. If you do not obtain the appropriate license bond, you will not be able to make money in the country, without breaking the law. Below, you will find a list of professionals, who will be required to obtain a license bond.

- Collection agencies

- Contractors

- Electric contractor

- Motor vehicle dealers

- Private investigator

5 Very Important Facts about Commercial Surety Bonds

- Can provide a 100% guarantee performance from a company that does not fall within the construction field.

- Do not require collateral postings, very cost effective, preserve financial capital, and can sometimes be utilized to replace a letter of credit document. Often utilized to pre-qualify a principal’s inherent qualities.

- The average annual rate is between 0.5-3 percent of the bond amount, but this will depend on the principal’s personal credit scores.

- Surety bond terms and definitions are standardized, but it is basically left up to the discretion of the surety company.

- Many provincial and territorial standards require commercial businesses to be bonded. Sometimes it is left up to the private company owner to make the decision of whether or not to get bonded, licensed, and insured.

Other Types of Surety Bonds we provide:

- Construction/Contract – For construction projects.

- License Bonds – Government bodies generally require you to obtain this type of bond.

- Court Bonds – Used to satisfy legalities.

To read the frequently asked questions regarding surety bonds: click here